Krachujúce banky

Komentáre

-

Ďalšie tri americké banky padajú

https://akw.sk/dalsie-tri-americke-banky-padaju/2 -

VIDEA: TAJNĚ NATOČENÉ ZÁBĚRY SCHŮZKY AMERICKÉHO REGULÁTORA FDIC o příštím finančním krachu, které se nikdo neměl dozvědět a finanční manažer z Wall Street Ed Dowd o biozbrani Covid19 a přicházející hluboké recesi.

Kromě členů FDIC byli u stolu také právníci a bankéři. Během setkání přiznávají, že finanční krach je na spadnutí. Nesmí se tomu věnovat velká pozornost, protože lidé si pak budou vybírat peníze od finančních institucí.

Na schůzce také se smíchem říkají, že nemají důvěru v bankovní systém. Dále zmiňují, že toto všechno nesmíte vědět, a že by měla být informována pouze vybraná skupina, tj. bohatí.

„Pokud bychom to odhalili, lidé by se vyděsili a vybrali by své peníze z banky. Pak by nebylo možné použít peníze lidí na záchranu jiných bank,“ říkají.

„Současná bankovní krize větší než v roce 2008,“ řekl ve čtvrtek ekonom Peter St Onge:

https://cz24.news/videa-tajne-natocene-zabery-schuzky-americkeho-regulatora-fdic-o-pristim-financnim-krachu-ktere-se-nikdo-nemel-dozvedet-a-financni-manazer-z-wall-street-ed-dowd-o-biozbrani-covid19-a-prichazejici-hl/4 -

Straty aktív v malých komerčných bankách sa opäť zrýchlili na rekordných 236 miliárd dolárov. Keďže dlhodobé sadzby minulý týždeň prudko vzrástli, straty čoskoro dosiahnu 300 miliárd dolárov a opäť sa stanú problémom pre bankový sektor.

Každý ďalší krok bude horší ako ten predchádzajúci

1 -

dlhodobé sadzby prudko vzrástli...

Vidno, že to písal Rus. Zvýšenie o 0,25 % je prudko? Načo zbytočne používa prídavné mená ? Minulý rok bolo prudko, keď na štyroch zasadnutiach FEDu sa dvihli sadzby vždy o 0,75 % z 1,00 % na 4,00 %. Tam bolo prudko na mieste.

Dnes je sadzba na 5,00 - 5,25 %. V 1980 boli sadzby nad 15,00 %. Samozrejme, vtedy bol podiel vládneho dlhu voči HDP pod 40 %, dnes je 130 %.

Platiť obsluhu dlhu 15 % z 270 miliárd (1980), 1,5 % z 20 biliónov a platiť 4,00 % z viac ako 30 biliónov je podstatný rozdiel.

0 -

Pád a prevzatie ďalšej banky v USA: FDIC zatvorila Kansas Heartland Tri-State Bank

Ramishah Maruf, CNN

28. júla 2023

Heartland Tri-State Bank of Elkhart, Kansas, v piatok padla, kontrolu prevzala Federal Deposit Insurance Corporation (FDIC).

FDIC súhlasila s prevzatím všetkých vkladov Heartland Tri-State Bank na ochranu zákazníkov a uzavrela zmluvu o kúpe a prevzatí s Dream First Bank of Syracuse, Kansas.

To znamená, že štyri pobočky Heartland Tri-State Bank sa v pondelok znovu otvoria ako pobočky Dream First Bank.

Nedávne zatvorenie bánk First Republic, Silicon Valley Bank a Signature Bank v tomto roku otriaslo bankovým priemyslom a prinútilo zákonodarcov zaviesť novú legislatívu na ochranu vkladov klientov a stabilizáciu finančného systému.

Heartland Tri-State Bank je prvou bankou, ktorá padla po First Republic, čo bol druhý najväčší krach banky v krajine, začiatkom mája.

FDIC uviedla, že zákazníci bánk môžu získať prístup k svojim peniazom vypísaním šekov alebo použitím bankomatov či debetných kariet. Taktiež nebudú musieť meniť svoje bankovníctvo, pretože sa automaticky stanú zákazníkmi Dream First Bank.

Heartland Tri-State Bank mala celkové aktíva približne 139 miliónov dolárov a celkové vklady 130 miliónov dolárov, uviedla FDIC. Dream First Bank tiež súhlasila s kúpou „v podstate všetkých“ neúspešných aktív Heartland Tri-State.

Úveroví zákazníci by tiež nemali byť do značnej miery ovplyvnení, povedal FDIC, pretože FDIC a Dream First Bank uzatvárajú dohodu, že sa budú podieľať na stratách a potenciálnych výnosoch z úverov.

Bank failure: Kansas Heartland Tri-State Bank closed by FDIC | CNN Business

3 -

Citizens Bank je piatou bankou, ktorá v tomto roku v krajine skrachovala.

Banková kríza v USA pokračuje, keďže ďalšia regionálna americká banka zatvára. Vláda zatvorila Citizens Bank kvôli finančným problémom, čo umožnilo Federálnej korporácii pre poistenie vkladov (FDIC) prevziať kontrolu bez toho, aby poskytla akékoľvek verejné varovanie. FDIC vydala 3. novembra vyhlásenie, v ktorom uvádza opatrenia prijaté voči Citizens Bank.

Citizens Bank je piatou bankou, ktorá v tomto roku v krajine zlyhala. Zoznam ďalších zlyhaných bánk ukazuje Heartland Tri-State Bank, First Republic Bank, Signature Bank, Silicon Valley Bank a First-Citizens Bank ako ostatné banky zatvorené v roku 2023. Odstávka sa začala 10. marca 2023, pričom First-Citizens Bank to uzatvára…

1 -

0

-

Spoločnosť WeWork, ktorá mala kedysi hodnotu 47 miliárd dolárov, vyhlásila bankrot

Podanie bankrotu je obmedzené na pobočky WeWork v USA a Kanade, uviedla spoločnosť v tlačovej správe. Spoločnosť WeWork vykázala celkové dlhy vo výške 18,65 miliardy USD oproti celkovým aktívam vo výške 15,06 miliardy USD v počiatočnom podaní.

WeWork debutoval prostredníctvom špeciálnej akvizičnej spoločnosti v roku 2021, ale odvtedy stratil približne 98 % svojej hodnoty. Spoločnosť v polovici augusta oznámila spätné rozdelenie akcií v pomere 1:40, aby sa jej akcie obchodovali späť nad 1 dolár, čo je požiadavka na udržanie kótovania na burze v New Yorku. Akcie WeWork klesli na minimum okolo 10 centov a pred zastavením akcie v pondelok sa obchodovali za približne 83 centov.

Spoločnosť si podľa svojich regulačných prihlášok prenajíma milióny štvorcových stôp kancelárskych priestorov v 777 lokalitách po celom svete.

https://www.cnbc.com/2023/11/07/wework-files-for-bankruptcy.html

0 -

Aktualizácia bankovej krízy: Odhadované nerealizované straty z dlhopisov vo výške 650 miliárd USD

Podľa nedávnych odhadov sa zdá, že banková kríza v roku 2023 zďaleka neskončila.

Veľké banky v súčasnosti čelia značným nerealizovaným stratám okolo 650 miliárd dolárov, ako uviedla agentúra Moody's.

Tento najnovší vývoj v prebiehajúcej bankovej kríze vznikol v dôsledku krachu na dlhopisovom trhu a následného výpadku trhu štátnych pokladníc, čo ovplyvnilo hodnotu dlhopisov v držbe týchto bánk.

Dôležité fakty

- Americké finančné inštitúcie podľa Moody's do 30. septembra naakumulovali vo svojich portfóliách nerealizované papierové straty v hodnote 650 miliárd dolárov.

- Banka Silicon Valley (SVB) skolabovala v dôsledku prepadu cien dlhopisov, čo viedlo k obavám, že podobný chaos môže postihnúť aj Wall Street.

- Otrasy na trhu štátnych financií spôsobili pád cien dlhopisov, čo ovplyvnilo ceny akcií veľkých finančných inštitúcií, ako je Bank of America.

- Výnosy 10-ročných štátnych dlhopisov nedávno po prvý raz za 16 rokov vyskočili nad 5 %.

- Bank of America odhalila potenciálnu dieru vo výške 130 miliárd dolárov vo svojej súvahe v dôsledku prepadu cien dlhopisov.

- Akcie Bank of America klesli za posledný rok o 24 % a medziročne o 14 %.

- Citigroup, JPMorgan Chase a Wells Fargo tiež utrpeli desiatky miliárd dolárov v nerealizovaných stratách.

- Larry McDonald, veterán trhu, vyjadril obavy z nerealizovaných strát veľkých bánk a naznačil, že Bank of America by mohla čeliť platobnej neschopnosti, ak Fed ďalej zvýši úrokové sadzby.

Čo sa deje dnes

Dopad sa neobmedzuje len na Wall Street, pretože viedol k poklesu cien akcií prominentných finančných inštitúcií vrátane Bank of America.

Základnú príčinu krachu dlhopisového trhu možno hľadať v obavách z rastúcich úrokových sadzieb a dlhodobej udržateľnosti značného deficitu Spojených štátov.

https://ai3d.blog/banking-crisis-update-estimated-650-billion-in-unrealized-bond-losses/

1 -

Nemá.

Jsou to nic neříkající pojmy. Těžko říct, zda se jedná o odborný termín či slátaninu kterou vygeneroval nějaký překladač. Jediná informace, kterou lze do mozaiky dostat je, že se to sype - nebo je to sypáno - což je samo o sobě informace dosti mlhavá.

V těchto záležitostech nejsme schopni analýzy.

0 -

Nerealizované straty nie je zlátanina, ale vyjadrenie, že síce na papieri majú cenné papiere stratu podľa aktuálneho kurzu voči kurzu, za ktorý sa realizoval nákup, ale nie je to reálna strata, lebo cenné papiere sú stále držané, držiteľ ich nepredal.

Ak banka kúpila dlhopis za kurz 102 a dnes má dlhopis kurz 100,5 , tak má nerealizovanú stratu 1,5 dolára na 100 dolárov, lebo ich drží, ale nepredáva. Ak kurz stúpne na 103, vtedy je v zisku 1 dolár na 100. Ak ho pri tom kurze aj predá, tak má realizovaný zisk, ak ho drží ďalej, tak v účtovníctve má nerealizovaný zisk.

Kurz dlhopisov klesá, ak sa zvýšia úrokové sadzby. Ak majú aktuálne dlhopisy výnos 4 %, tak pri zvýšení sadzieb centrálnou bankou klesne ich aktuálny kurz, aby výnos odrážal novú úroveň sadzieb, lebo novovydané dlhopisy už budú mať vyššie výnosy (úrokovú sadzbu) ako predtým emitované dlhopisy a všetci budú kupovať dlhopisy s vyšším úrokom.

To je zjednodušené vysvetlenie princípu, v realite je to komikovanejšie, lebo sa špekuluje na rast/pokles úrokov v predstihu a podľa toho sa buď nakupuje, alebo predáva. Preto správa v stredu večer o 20:00 nášho času, že FED zdvihol úroky nemusí mať žiaden vplyv na kurzy, lebo obchodníci to už zarátali vopred do ceny.

Inak povedané, nerealizovaný/realizovaný zisk/strata je trhové ocenenie portfólia cenných papierov, ktoré máš v držbe. Napríklad v podielovom fonde správcovskej spoločnosti, alebo v druhom pilieri dôchodkového sporenia.

6 -

Lin, to video si pozriem. Zatiaľ len úplný začiatok. Zaisťovacie deriváty a dôchodok... panenka skákavá ! Finančný produkt musí byť úplne jednoduchý, aby to pochopil aj obyčajný človek ! Zaisťovací derivát je niečo, čomu nerozumejú ani tí takzvaní finančný poradcovia, nieto ten bežný sporiteľ. Čím komikovanejší názov, produkt, tým väčším oblúkom sa tomu treba vyhnúť. Zaisťovať znamená, že niečo chcem poistiť voči strate. Ak mám akcie, tak pre pád akciových trhov je v produkte vsunutá nejaká tzv. ochrana. Niečo, čo bude rásť, ak akcie klesajú. No a tam finanční kúzelníci nasúkajú hocičo, čo vo výsledku môže aj zväčšiť stratu hodnotu akciovej zložky. Oni sa držia hesla "príde hlúpy, čo to kúpi." Zaisťovanie v ich žargóne znamená zahmlievanie, zastieranie, kamuflovanie.

3 -

Je to celé o tom, co chtějí u nás v ČR nyní nově nabízet jako spoření na důchod. Tzv. DIP - Dlouhodobé

investování na důchod. Info třeba tu:

https://www.novinky.cz/clanek/finance-duchod-ma-vylepsit-investovani-planuje-vlada-40435915

Předpokládám, že jde o jednu z variant, jak z lidí ještě vytáhnout zbylé peníze. Nyní finišují se zákonem,

tak uvidíme copak vymyslí.

1 -

64 pobočiek bánk v USA sa má zatvoriť za jediný týždeň

GENERALMCNEWS, 4. decembra 2023

Veľké banky ako PNC Bank a JPMorgan Chase podali návrh na zatvorenie niekoľkých pobočiek vo viacerých štátoch podľa znepokojujúceho vzoru rastúceho zatvárania pobočiek v posledných rokoch.

V období medzi 12. a 18. novembrom niekoľko bánk požiadalo o zatvorenie pobočiek, pričom podľa údajov Úradu kontrolóra meny v USA (U.S. Office of the Comptroller of the Currency) najviac PNC Bank. PNC Bank so sídlom v Pittsburghu požiadala o zatvorenie 19 pobočiek – päť v Pensylvánii, štyri v Illinois, tri v Texase, dve v Alabame a New Jersey a po jednej v Indiane, Ohiu a na Floride.

JPMorgan Chase tesne nasledovala s 18 podaniami – tromi v Ohiu, po dvoch v Connecticute a Južnej Karolíne a po jednom v 11 štátoch vrátane New Yorku, Illinois, Floridy a Massachusetts.

Citizens Bank sa umiestnila na treťom mieste s 8 žiadosťami o zatvorenie pobočiek – šiestimi v New Yorku a po jednom v Massachusetts a Delaware.

U.S. Bank so sídlom v Minneapolise podala žiadosť o 7 zatvorení – tri v Tennessee a po jednom v Missouri, Wisconsine, Ohiu a Illinois.

Bank of America podala 5 žiadostí – dve v New Yorku a po jednom v Texase, Massachusetts a Kalifornii.

Citibank podala žiadosť o zatvorenie 2 pobočiek a Sterling, Bremer, First National Bank of Hughes Springs, Windsor FS&LA a Aroostook County FS&LA podali po jednom podaní.

Spolu banky podali návrh na zatvorenie 64 pobočiek.

Nedávne zatváranie pobočiek je súčasťou dlhodobého trendu zatvárania pobočiek, ktorý prebieha už niekoľko rokov. Zo správy Národnej komunitnej reinvestičnej koalície (National Community Reinvestment Coalition ) vyplýva, že v rokoch 2017 až 2021 zatvorilo 9 percent všetkých pobočiek bánk. Miera zatvárania sa počas pandémie COVID-19 zdvojnásobila.

Podľa údajov S&P bolo v minulom roku zatvorených 3 012 pobočiek a otvorených 958 pobočiek, čo viedlo k čistému zatvoreniu 2 054 pobočiek. Toto bol tretí rok po sebe, kedy čisté uzávierky prekročili 2 000.

1 -

Bomba BOJ: 12 amerických gigantů přerušilo spolupráci s poskytovateli kreditních karet, američtí bankovní giganti chystají masivní exodus.

Šokující obrat událostí: Dvanáct nejvlivnějších bank ve Spojených státech zasadilo tradičnímu finančnímu prostředí drtivou ránu. S platností od půlnoci na čtvrtek 14. prosince tyto bankovní giganty formálně přerušily vztahy se svými poskytovateli kreditních karet, čímž předznamenaly seismickou změnu v tomto odvětví.

Exodus začíná: Banky v USA se loučí s poskytovateli kreditních karet.

Zatímco hodiny odtikávají do historického okamžiku, bankovní giganti zaslali svým partnerům v oblasti kreditních karet formální oznámení o ukončení poskytování jejich služeb. Tento krok, který svým rozsahem a odvahou nemá obdoby, vyvolává nesčetné otázky o budoucnosti finančních institucí a jejich vztahů s poskytovateli úvěrů.

Tento strategický manévr vyvolal šok v globálním finančním ekosystému a přiměl analytiky spekulovat o motivech náhlého a synchronizovaného odchodu. Důsledky tohoto rozhodnutí sahají daleko za hranice Spojených států a ovlivňují samotné základy bankovnictví v globálním měřítku.

Globální finanční krajina v pohybu: fyzické pobočky na prodejním špalku

Současně s tímto bombastickým oznámením se stupňuje trend, kdy finanční instituce po celém světě zavírají své fyzické pobočky. Kdysi ustálený trend uzavírání klasických poboček se změnil v horečný závod směrem k digitální budoucnosti.

Tento fenomén hromadného uzavírání poboček mění způsob, jakým zákazníci komunikují se svými bankami, a tlačí je k online platformám a mobilním aplikacím. Důsledky pro zaměstnance jsou ohromující, protože tisíce zaměstnanců čelí nejisté budoucnosti uprostřed vlny uzavírání poboček.

BOJ prohlášena za "mozkově mrtvou": Odhalení záhady, která se skrývá za tímto odvážným prohlášením.

Uprostřed těchto tektonických změn ve finančním sektoru se objevilo záhadné prohlášení: "BOJ (Bank of Japan) je mozkově mrtvá". Analytici a odborníci z odvětví se snaží rozluštit význam tohoto odvážného prohlášení. Signalizuje krizi v Bank of Japan, nebo jde o kódovanou zprávu odrážející širší stav centrálního bankovnictví na celém světě?

Zkratka "BOJ" obvykle označuje Bank of Japan, jednu z nejvlivnějších centrálních bank na světě. Prohlášení o tom, že je "mozkově mrtvá", však do již tak bouřlivého finančního prostředí vnáší prvek intriky a naléhavosti.

V následujících kapitolách se budeme věnovat jednotlivým událostem, odhalíme motivy rozhodnutí bank přerušit vztahy s poskytovateli kreditních karet, prozkoumáme globální posun směrem k digitálnímu bankovnictví a pokusíme se rozluštit záhadnou zprávu týkající se Bank of Japan......

https://amg-news.com/the-boj-bombshell-12-u-s-giants-cut-ties-with-credit-card-providers-u-s-banking-giants-stage-massive-exodus/

1 -

GB

Banky vo Veľkej Británii zatvoria v roku 2024 ďalšie pobočky

29. decembra 2023 od Save Britain

Klienti bánk sú upozorňovaní na blížiacu sa vlnu zatvárania pobočiek, ktorá sa očakáva v roku 2024. V Spojenom kráľovstve sa zatvorenie pobočiek bánk a stavebných sporiteľní zhoršilo v dôsledku rastu online bankovníctva.

Hlavní veritelia potvrdili ďalšie uzavretia, čo znamená, že táto miera približne 54 za mesiac bude pokračovať aj v roku 2024.

Nasledujúce banky zatvoria svoje pobočky v roku 2024: Barclays, Halifax, Lloyds a NatWest. Medzitým HSBC UK prisľúbila, že nezverejní žiadne ďalšie uzávierky.

Nižšie je uvedený súhrn všetkých doteraz potvrdených uzávierok na rok 2024:

Bank of Scotland: 16

Barclays: 34

Halifax: 47

Lloydovia: 60

NatWest: 21

RBS: 1

Ulster Bank: 10

Od januára 2015 sa v Spojenom kráľovstve zatvorilo už približne 5 791 bankových pobočiek.

https://savebritain.org/list-high-street-banks-in-the-uk-to-close-in-2024/#google_vignette

1 -

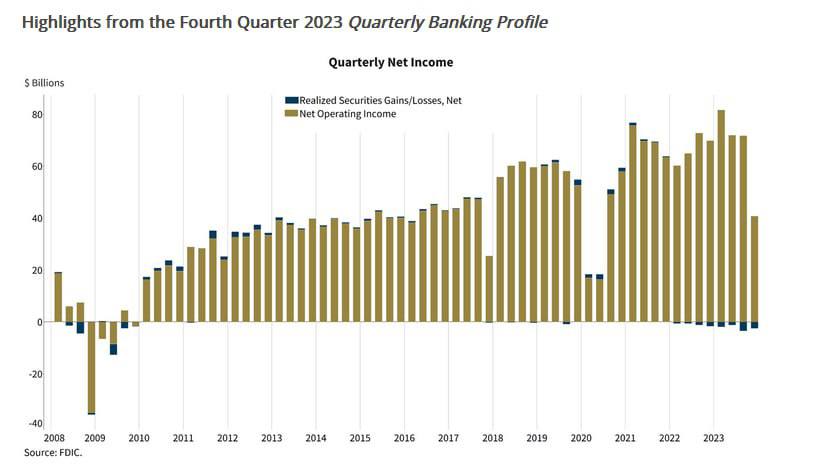

Zisk amerických bánk sa v štvrtom štvrťroku 2023 znížil o 44 %. Federálna korporácia pre poistenie vkladov (FDIC) tvrdí, že bankový sektor naďalej čelí „významným rizikám poklesu“. Monitorovaniu podliehajú najmä kancelárske priestory a iné typy úverov CRE.

FDIC tiež pridal osem bánk na svoj zoznam „problémových bánk“, čím sa celkové aktíva týchto problémových spoločností zvýšili na 66,3 miliardy dolárov.

0 -

Krachovanie bánk v USA.

Podľa údajov FDIC siahajúcich do roku 1936 bolo len päť rokov bez skrachovania bánk poistených FDIC. Počas dvoch rokov pandémie bez peňazí – 2021 a 2022 – neskrachovala žiadna banka. V roku 2018 neskrachovala žiadna banka. V rokoch 2006 a 2005 neskrachovala žiadna banka. A to bolo všetko.

V každom zo zostávajúcich 88 rokov niektoré banky zlyhali. V roku 1989, na vrchole krízy S&L a po ropnom páde, zlyhalo 531 bánk – a ľudia kvôli tomu išli do väzenia.

V roku 2010 počas finančnej krízy skrachovalo 155 bánk. Ale banky boli už oveľa väčšie ako v roku 1989. A v zákernom zvrate udalostí nikto nešiel do väzenia; namiesto toho bankári v bankách, ktoré dostali záchranu, dostali rekordné bonusy.

V roku 2023 skolabovalo šesť bánk: Silicon Valley Bank, Signature Bank, First Republic, plus dve veľmi malé banky v Iowe a Kansase boli prevzaté FDIC. A Silvergate Bank, ktorej regulátori dýchali na krk, súhlasila so samolikvidáciou, ale keďže mala dostatok aktív na krytie svojich vkladov bez účasti FDIC, FDIC ju nepočíta ako „skrachovanú banku“. Oficiálne teda bolo päť „skrachovaných bánk“ a jedna samolikvidácia.

V roku 2024 niektoré banky skrachujú. Do značnej miery to vieme; len nevieme kolko. Ak by zlyhalo osem bánk, bolo by to na úrovni rokov 2015 a 2017.

Komerčné banky naďalej zanikajú.

V roku 2023 si fúzie vzali 100 bánk; krach bánk a samolikvidácia vyradila 6 bánk; ale vzniklo 6 nových bánk.

Na konci roka 2023 sa počet bánk znížil na 4 026 komerčných bánk, z viac ako 14 000 v 80. rokoch. Rovnako ako v roku 2023 veľká väčšina bánk zanikla, pretože ich kúpili iné banky, nie kvôli krachom bánk.

Celý článok na:

0

Kategórie

- Všetky kategórie

- 1 Možnosti, riešenia, východiská, ciele

- 220 Politika a udalosti

- 81 Udalosti a politika na Slovensku

- 24 Udalosti a politika v ČR

- 63 Zahraničná politika a udalosti

- 51 Globálna politika a udalosti

- 26 Analýzy

- 4 Domáci analytici

- 19 Zahraniční analytici

- 5 Metódy vládnutia

- 25 Svetonázor

- 49 Ideológia - filozofia, náboženstvo, technológia

- 238 KSB

- 2 Osbeživa

- 24 Dejiny a chronológia

- 34 Biologické zbrane

- 18 Ekonomika a financie

- 10 Násilie, zbrane, vojna

- 46 Egregoriálno-matričné riadenie

- 12 Jazyk životných okolností

- 17 Kultúra

- 8 Filmy, videá

- 4 Literatúra

- 4 Hudba

- 35 Zdravie

- 19 Podnety k fóru

- 5 Pomôcky a návody k fóru

- 118 Mimo kategórií